Whether you leave the workforce at the traditional age of 65, hold out for 75, or start early at 35, retirement marks a new chapter in your personal and financial life. If you are imagining a worry-free romp through your golden years, there’s no time like the present to start preparing. But first, make sure you aren’t sidetracked by these common retirement myths and misconceptions.

Retirement Myth #1: You will retire when you are 65.

Why do most people assume that retirement begins at 65? Because, traditionally speaking, pensions and Social Security paid full benefits at age 65, which created a disincentive to work. These days, pensions are becoming more and more rare and Social Security no longer offers enough to sustain a lifestyle. The truth is, for most of us, retirement begins when we can afford it—whether that is at 47 or 74. In a perfect world, you will be able to retire when you are still young and healthy enough to enjoy it, but there are no guarantees.

Retirement Myth #2: Once you retire, you’ll be done working forever.

According to the U.S. Bureau of Labor Statistics, approximately 1.5 million retirees who left the workforce in 2020 have now gone back to work. There are several reasons, but the greatest among them is inflation. After the dust settles, some retirees choose to go back to work (although not always to the same job) because they find that their retirement fund does not efficiently cover their expenses. Many retirees also choose to go back to work because they discover that they are happier when they have responsibilities, scheduled social interaction, and a reason to leave the house.

Retirement Myth #3: You can work as long as you need to.

Aging is unpredictable. Even if you have spent your young adult life being spry and ambitious, don’t depend on that continuing as long as you need or want it to. In fact, more than half of all early retirements are due to illness or disability. Prepare for all possibilities to avoid being left in a lurch.

Retirement Myth #4: You’ll only live to be 75-85 years old.

Thanks to changing habits and medical advancements, Americans today are living longer than ever before. So, although the average American life expectancy is 77 years, it’s reasonable to expect that you’ll live well beyond the average. In fact, you may spend as long in retirement as you did in your career.

Retirement Myth #5: Your expenses will suddenly decrease.

The amount of money you’ll need when you retire depends on several factors. Many people assume that without commuting costs and a daily latte habit, their expenses will drop significantly in retirement, but often the opposite is true. Depending on your goals, you could end up spending even more in retirement than you did while working—especially if you plan to travel, care for grandchildren, or pursue hobbies. Inflation could also make it more expensive to do the things you plan to do, so don’t expect to get by on what you are spending now.

Retirement Myth #6: You’ll pay less in taxes.

Expecting a lower tax rate is also unwise because your tax rates will only fall if you have a smaller income in retirement than you had while you were working. If your income remains about the same, you may not qualify for a lower tax bracket. Also, you may qualify for fewer tax breaks (such as mortgage and college savings deductions).

Retirement Myth #7: Medicare will cover all your health care costs.

One of the most common retirement planning myths is that Medicare will be enough to cover all future healthcare costs. Of course, Medicare is an invaluable program for many retirees, but it was never designed to cover everything. In reality, dental care, vision care, and hearing care are often not covered. Plus, out-of-pocket deductibles and copays (which can be significant) may make receiving care too costly. What’s more, if you end up needing additional or specialized care, coverage for a nursing home and other long-term care is often limited. To prepare yourself before you are in a pinch, explore supplemental insurance options that will support all your healthcare needs.

Retirement Myth #8: You don’t need to worry about retirement until you are older.

When you are just starting out, it’s easy to believe that time is on your side. After all, when you are entering the workforce or graduating college, retirement seems a long way away. In your 20s, you may think you have a lifetime to build a 401(k) or retirement fund. Or you may reason that—if nothing else–you’ll have social security to rely on. The truth is social security will not likely provide enough to cover all your monthly expenses—especially if you are still paying off a mortgage or other debts. Build an early habit of setting aside money for retirement, and that habit will stay with you for your entire life.

Retirement Myth #9: Your 401(K) is a safety net for emergencies.

When times get tough, many people look to their 401(k) as a source of emergency cash, but there are big risks involved with that mindset—not the least of which is a loss of accumulated wealth. When you withdraw money from your retirement accounts before the age of 59 1/2, you could also incur early withdrawal penalties and taxes. For example, if you remove $10,000 from your 401(k) to cover a medical debt or home repair, you’ll immediately lose $1,000 of it and pay additional taxes on the withdrawal. That said, if you hit a rough patch and have no other means to cover it besides your 401(k), you are better off taking that money out as a 401(k) loan than as an early withdrawal (if your plan has that option). There are, of course, risks to such loans—like a limited payback window and the requirement to pay the loan back in full if you leave your job—so be sure to explore all of the terms and conditions before making any decisions.

NOTE: According to CNBC, congress recently passed new retirement account rules that will allow savers to make one withdrawal of up to $1,000 a year for personal or family emergency expenses. The measure allowing this change—which takes effect in 2024 and also applies to individual retirement accounts—waives the 10% tax penalty. When it goes into effect, you can self-certify in writing that you need the funds for an emergency.

Retirement Myth #10: Saving for retirement will get easier as you age.

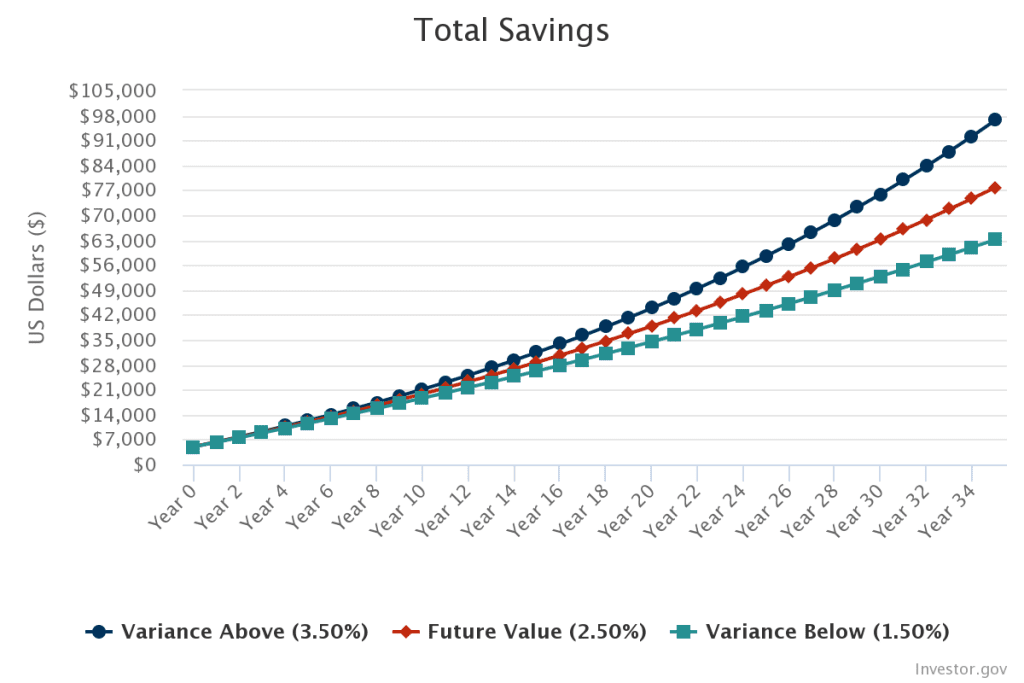

In the Aesop fable The Ants and the Grasshopper—which inspired the Pixar movie, A Bug’s Life—we learned that it is wise to prepare today for the wants of tomorrow. The same is true for retirement. Young adults have a huge advantage when it comes to building wealth for retirement because they can maximize the power of compound interest. With compounding interest, you can save a little now and reap big rewards later. If you map out a retirement plan—or simply open a compound interest savings account—in your 20s, you can build a healthy nest egg that will make a comfortable retirement (before 70) more achievable. If you are curious, use the Compound Interest Calculator from the U.S. Securities and Exchange Commission to see how much your money can grow using just the power of compound interest. For example, if (at 25) you open an account with $5,000 that earns an estimated 2.5% APY (with a variance range of 1%) and contribute $100 a month, in 35 years you could accrue more than $77,000 (see figure below).

There are myths about retirement everywhere and the truth is, everyone’s plan will be different. What worked for your parents may not work for you. In fact, the habits that are working for your friends may not work for you. Know yourself and follow the path that will help you build enough wealth to have the retirement of your dreams. Whatever path you take, the bottom line is, the sooner you begin saving, the better.