Your credit score is just a three-digit number, but it holds immense power. Like our social security numbers, we carry (and use) our credit scores through most of our adult life. In fact, most of us spend more time building our credit scores than we do building romantic relationships.

Why does it matter? While the information on your credit reports may have less of an impact on your everyday life than the numbers in your bank accounts, your credit history and score can have a huge impact on your overall financial well-being. That’s because—for better or worse—your credit score can influence whether you can secure a loan, get a credit card, buy a home, or even land a job.

If you don’t already know how you measure up on the credit score scale, it’s wise to get familiar with your number and keep an eye out for changes. By keeping track of your credit history, you can not only build and maintain a good credit score but also catch and address any potential issues before they become catastrophic.

About Credit Reports

Your credit score is based on your credit report, a summary of your personal credit history. It includes identifying information (like your address, date of birth, and social security number) and information about how you pay your bills or whether you have ever filed for bankruptcy. There are three agencies—Experian, Equifax, and TransUnion—that collect and compile this data.

How it Starts

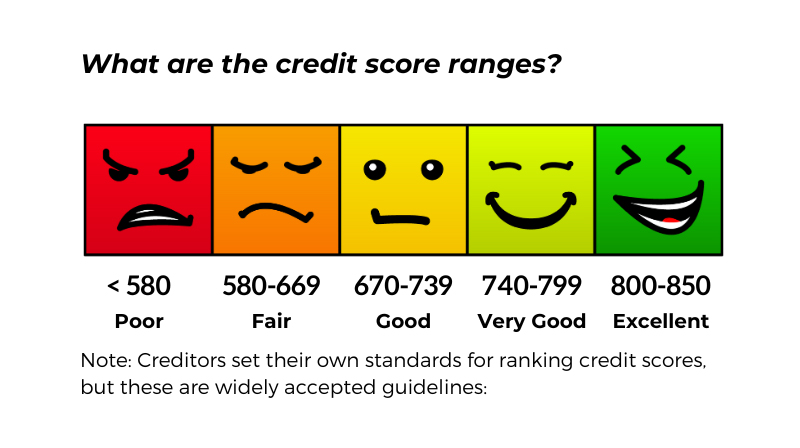

Everyone’s journey is different, but most of us get our first credit score within 6 months of taking on our first debt—either as a borrower ourselves or as an authorized user on someone else’s account. We don’t, however, start out at zero. (In fact, the lowest possible score is 300.) We also don’t start at the top of the scale (which is 850). Before you take out a loan or apply for a credit card, you’ll simply have no credit score at all. Once you begin to interact with your credit history (make payments, miss payments, apply for more credit, etc.), you will see that score change.

When you have no credit history, you are considered a high-risk borrower because lenders have no way to predict how likely you are to pay your bills on time. Having no credit is not quite as bad as having a bad credit score, but as romance novelist Lisa Kleypas says, “Getting to a higher spiritual level is like increasing your credit score. You get a lot more points for sinning and repenting than if you have no credit history at all.”

Why Your Credit Score Matters

- Loan Approval and Interest Rates: A good credit score significantly increases your chances of being approved for loans. It also helps you qualify for lower interest rates, which can save you substantial amounts of money over time.

- Credit Card Approval and Limits: Credit card companies assess your credit score to determine your creditworthiness. A higher credit score often means higher credit limits and better terms on your credit cards.

- Renting a Home: Landlords often check credit scores to evaluate rental applications. A good credit score can help you secure a rental agreement more easily.

- Employment Opportunities: Some employers conduct credit checks as part of the hiring process, particularly for positions that involve financial responsibility. A good credit score can enhance your employment prospects.

Tips to Improve Your Credit Score

1. Pay Your Bills on Time

Timely payments are the most important factor in determining your credit score and late payments will stay on your record for 7.5 years. Set up reminders or automatic payments to ensure you never miss a due date.

2. Reduce Credit Card Balances

Your “credit utilization” is the second most important factor and it is ranked by the amount you owe compared to your credit limit. For example, if you have a $10,000 limit and owe $5,000, your credit utilization rate is 50%. Aim to keep your credit card balances below 30% of your credit limit, as credit utilization rates above 30% can negatively impact your credit score.

3. Don’t Close Old Accounts

The length of your credit history matters because keeping old, well-managed accounts open will showcase your creditworthiness over time. When you pay off a high-balance credit card, it may be tempting to destroy the card, but there is value in keeping a zero-balance card open—especially if that account is several years old. That’s because the older your average credit age, the more reliable you appear to lenders. Plus, if you choose to close an account, it will lower your credit limit—which also increases your credit utilization rate. Either way, the payment history on those paid-off loans and credit cards will still factor into your credit history—possibly for as long as 10 years.

4. Diversify Your Credit Mix

Having a mix of credit types (e.g., credit cards, mortgages, auto loans) can positively impact your credit score. There are two main types of credit—revolving and installment. Revolving credit is credit with an upper limit (such as a credit card or home equity line of credit, a.k.a., a HELOC). With revolving loans, when you pay down your balance, you can use that credit line again. Installment loans are loans in which you receive a lump sum and then repay it in regular installments over time (such as an auto loan, student loan, or mortgage). If you have only one type, it could be beneficial to mix things up, but be sure to only borrow what you can comfortably manage.

5. Limit New Credit Applications

Increasing and diversifying your credit can help increase your credit score but it’s even more important to be thoughtful about opening new accounts. Initiating multiple credit inquiries (often called “hard inquiries” or “hard pulls”) within a short period can lower your credit score. Be selective and deliberate when applying for new credit.

6. Negotiate with Creditors

If you’re struggling with payments, consider negotiating with your creditors for lower interest rates, a payment plan, or a settlement amount.

7. Ask for a Credit Limit Increase

When your credit limit goes up, but your balance stays the same, your overall credit utilization rate goes down—and that can improve your credit score. So, if your income has recently gone up or you’ve had a few successive years of positive credit experience, you have a good shot at getting approved for a higher limit. However, before you request an increase, give some thought to how you’ll keep your spending habits steady. If you think you might be tempted to spend that extra available credit, this might not be the best strategy for you.

8. Get a Secured Credit Card or Become an Authorized User

If you have bad credit or no credit, a secured credit card or loan may be just what you need to build a positive credit history. They are often easier to secure because you pay a cash deposit upfront, and your credit limit is then equal to (and backed by) the cash deposit or savings account.

If you don’t have the means to secure a new loan or credit card, consider asking a trusted friend or relative who has a credit card account if you can be added as an authorized user. They don’t have to let you use the card (or even give you the account number) for your credit to improve as long as they have (and maintain) a good history of on-time payments. This is sometimes known as “credit piggybacking”.

7. Check Your Credit Report Regularly

Check your credit report regularly (at least once or twice a year) to watch for improvement and unexpected changes. You can obtain a free credit report annually from each of the major credit bureaus (see below) to check for inaccuracies or fraudulent activity.

How to Monitor Your Credit Score

You can get one free copy of your credit report from each of the three major credit monitoring bureaus—Experian, Equifax, and TransUnion (additional inquiries may cost as much as $14.50). You can also view an estimated credit score online with these companies or through the online credit service, Credit Karma. The credit scores and reports you’ll get from Credit Karma come directly from TransUnion and Equifax (two of the three major consumer credit bureaus), so it should give you an accurate reflection of your credit information as reported by those credit bureaus.

You can also get a free report if any of the following circumstances apply:

- You were denied credit, insurance, or employment based on a credit report within the past 60 days.

- You believe your report is inaccurate due to fraud.

- You are unemployed and intend to apply for employment within 60 days from the date of your request.

- You receive public assistance.

Building and maintaining a good credit score is a crucial step toward achieving financial stability and securing your future. By being proactive, responsible, and informed, you can improve your credit score and open up a world of opportunities for a better financial life. Remember, your credit score is a reflection of your financial health, so manage it wisely. If you need help, talk to someone in our lending department or get FREE financial counseling from our partners at GreenPath Financial Wellness. As a Maps member, you have access to free one-on-one financial counseling, debt management services, and personalized credit report reviews.