Student loan forgiveness scams are on the rise, targeting borrowers with promises of quick relief, debt forgiveness, or special access to government programs. And now, with involuntary collections on defaulted federal loans set to resume, there’s bound to be confusion and anxiety around repayment and defaulted debt. The bad news is that scammers are also paying attention to the news about student loans—and they are quick to take advantage of the chaos. Because let’s face it—when we’re vulnerable, we’re more likely to fall for something that sounds like a lifeline. Here are 8 red flags that can help you avoid becoming a victim.

1. They Promise Instant Forgiveness 🚩

Legitimate loan forgiveness programs (like Public Service Loan Forgiveness or Income-Driven Repayment forgiveness) take years, not days, to complete. If someone claims they can “get your loans forgiven today,” it’s likely a scam.

2. They Ask for Upfront Fees 🚩

If someone asks you to pay a “service,” “subscription,” enrollment,” or “maintenance” fee, walk away. You never need to pay money to apply for federal loan forgiveness, consolidate your loans, or adjust your repayment plan. Scammers may charge hundreds of dollars for services you can access for free at studentaid.gov.

3. They Use High-Pressure Tactics 🚩

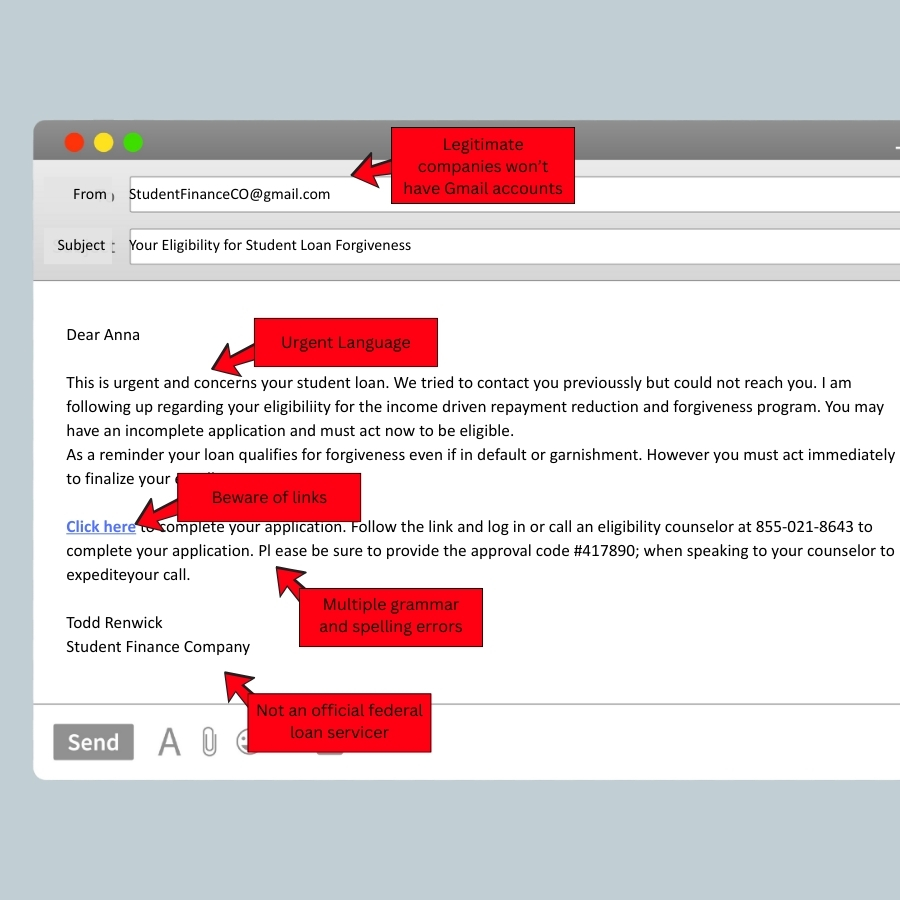

Scammers may urge you to “act now before it’s too late” or say the offer is only available for a limited time. So, be skeptical if you encounter urgent language and high-pressure sales tactics. Real federal programs don’t work that way. Take your time and verify everything.

4. They Aren’t an Official Loan Servicer for the Federal Government🚩

Scammers often impersonate government agencies using generic names like “Student Loan Help Center” or “Federal Student Aid Department.” Always verify who you’re dealing with by going to official government websites or calling your loan servicer directly. If you don’t know who is servicing your loan, log in at StudentAid.gov to visit your account dashboard or call the FSAIC.

And, as FSA points out, there is a small list of contracted federal student loan servicers that work with the federal government to support borrowers, including:

- Default Resolution Group (myeddebt.ed.gov)

- Edfinancial (edfinancial.StudentAid.gov)

- MOHELA/Missouri Higher Education Loan Authority (mohela.StudentAid.gov)

- Aidvantage (aidvantage.StudentAid.gov)

- Nelnet (nelnet.StudentAid.gov)

- CRI (cri.StudentAid.gov)

- ECSI/Educational Computer Systems (efpls.ed.gov)

5. They Want to Consolidate Your Loans But Are Sketchy on the Terms 🚩

Loan consolidation can be helpful, but it can also reset the clock on forgiveness eligibility or change your interest rates. Scammers may push consolidation just to charge a fee. Before signing anything, make sure you understand the pros and cons.

6. The Communication Is Full of Typos or Suspicious Email Addresses 🚩

Scam emails may look official at first glance but often contain spelling mistakes, unusual capitalizations, odd grammar, or strange email addresses (like @loanhelp-now.com instead of a .gov domain). Avoid following links and always double-check the source before interacting.

7. They Advertise on Social Media🚩

If you see an ad on Instagram, Facebook, or TikTok promising instant student loan forgiveness or “special access” to government programs, proceed with caution. Chances are that the companies are not affiliated with the Department of Education. In the best-case scenario, they charge high fees for services you could otherwise get for free. At worst, it’s an outright scam designed to collect your personal information or steal your money. Remember—official loan forgiveness programs are never advertised this way, and you’ll never be asked to apply through a third-party site.

8. They Ask for Your FSA ID or Log-in Info 🚩

Your log-in information is your electronic signature. Sharing it is like giving someone a blank check. No legitimate service or agency will ask you to provide your FSA ID or log-in information over the phone or by email.

And, while legitimate government programs (like Public Service Loan Forgiveness and Income-Driven Repayment plans) may require your Social Security number (SSN) to verify your identity and eligibility, they won’t request it via unsolicited contact methods (like phone calls and emails). So, it’s crucial to verify the legitimacy of the request and avoid sharing your SSN with unknown or suspicious parties

What to Do If You Think You’ve Been Scammed

If you suspect you’ve fallen for a student loan forgiveness scam, don’t panic—but do act quickly. Taking the right steps can help limit the damage and protect your finances moving forward.

Here’s what to do:

- Contact your loan servicer immediately to confirm the status of your loans and discuss the next steps.

- Report the scam to the Federal Trade Commission (FTC). You can also file a complaint with the Oregon Department of Justice online or at 877.877.9392.

- Regularly check your credit reports for unusual activity and dispute anything suspicious. You’re entitled to a free report every week at AnnualCreditReport.com.

- Consider placing a fraud alert or credit freeze with the major credit bureaus if you believe your personal information has been compromised.

- Change passwords on any affected accounts, especially if you shared login credentials or used the same password elsewhere.

Even if you’re not 100% sure what you experienced was a scam, it’s better to report it and let the authorities investigate.

Have a Plan—Don’t Get Scammed

Scammers thrive on confusion and urgency—two things a lot of student loan borrowers are dealing with right now. So, create a plan to manage your payments and stay informed.

Here are a few tips:

- Know your servicer. Log in at StudentAid.gov to confirm your loan details and servicer contact info. That way, you’ll recognize legitimate communication when it comes.

- Never pay upfront fees. No legitimate loan forgiveness or consolidation program charges a fee to apply.

- Be skeptical of pressure tactics. Scammers often create a false sense of urgency. Real programs won’t pressure you to act “before a deadline” or lose your spot.

- Use official sources. For the latest updates on student loan repayment, forgiveness, and relief programs, rely on trusted sites like StudentAid.gov or the Department of Education—not social media ads or unsolicited calls.

- Stay in the loop. Set reminders to review your loan status periodically, especially after policy changes. Scammers count on borrowers being too busy or overwhelmed to notice red flags.

Most of all, if you’re a Maps member and feel unsure about managing your student loan payments alongside your budget or other loans, reach out—we’re here to help you make a plan that works for you.

Want more tips on how to avoid scams?

- Test your scam detection skills with our “Are You Scam Savvy?” quiz.

- Learn how to secure your Alexa, Siri, or Google Assistant device.

- Find out how to protect your data and finances using mindfulness tactics.