Solutions Spotlight

Categories

-

Maps Credit Union: Now Serving theWilsonville Community

Wilsonville is more than just a gateway between Portland and Salem; it is a vibrant, growing community characterized by innovation, family-oriented neighborhoods, and a robust local economy. As the city continues to expand, the need for reliable, community-centered financial partners… Read More »

-

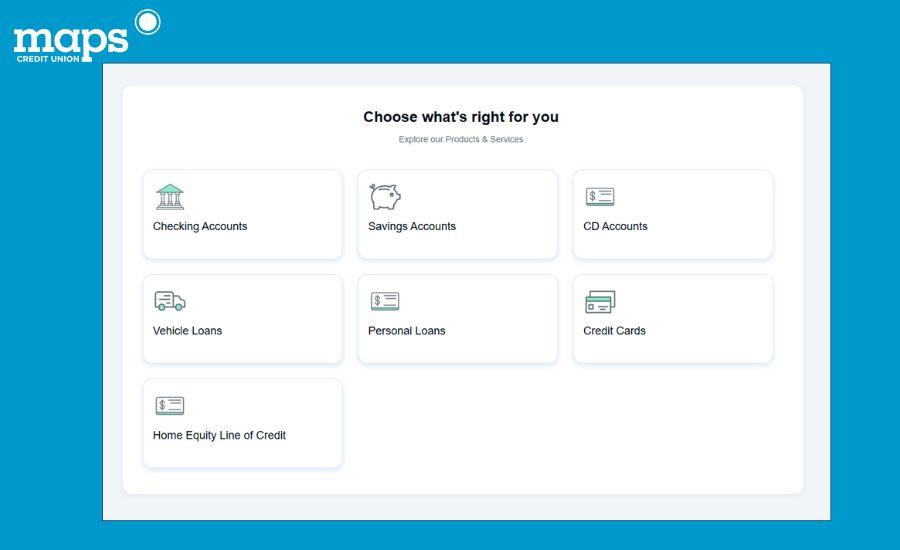

Types of Accounts and When to Use Them

A simple guide to common bank and credit union accounts, what they’re for, and how to choose the right mix for your money. Read More »

-

How to Get Paid Sooner With Direct Deposit

Waiting for payday can sometimes feel like waiting forever. Whether you’re covering monthly bills, planning a weekend trip, or managing everyday expenses, getting access to your money faster makes a big difference. That’s where Maps Credit Union’s Early Paycheck feature… Read More »

-

Say Goodbye to Hidden Fees: Why No-Fee Checking Makes Sense

Managing everyday money shouldn’t come with extra charges just to keep your account open. For many Oregonians, traditional checking accounts often come with monthly service fees that can eat away at their balance. A no-fee checking account skips that cost,… Read More »

-

How to Choose the Best High-Yield Savings Account in Oregon

Why Choosing the Right Savings Account Matters A savings account is more than just a place to hold your money; it’s a tool to help your funds grow over time. For Oregon residents, choosing the right high-yield savings account can… Read More »

-

12 Common Myths About Credit Unions

Think we can’t compete with banks? We bust some common credit union myths to explain why they might be the smarter choice for your money. Read More »

-

Exploring a Credit Union HELOC in Oregon: What to Know

If you’re a homeowner in Oregon, your home might be worth more than you think, not just in value, but in potential. A Home Equity Line of Credit (HELOC) gives you access to that potential by allowing you to borrow… Read More »

-

How a Credit Union Money Market Account Can Help Oregonians Grow Their Savings

For Oregonians seeking to maximize their savings, traditional options may not go far enough. A regular savings account keeps your money secure, but the interest may not significantly contribute to growing your balance. That’s where a Money Market Account comes… Read More »

-

Free Checking Accounts vs Traditional Checking: What Oregon Residents Should Know

Why Choosing the Right Checking Account Matters A Checking Account is your financial home base where your paycheck lands, your bills get paid, and your spending is tracked. But not all Checking Accounts are created equal. Some come with monthly… Read More »

-

How to Secure an Affordable Auto Loan at a Credit Union in Oregon

Securing an affordable auto loan in Oregon is a key step in purchasing a vehicle. Credit unions, such as Maps Credit Union, offer flexible auto financing options that can result in manageable monthly payments for both new and used cars,… Read More »