Our Blog

Categories

-

Time for a Financial Health Checkup

Review your finances with this simple year-end financial health checkup designed to help you enter 2026 with confidence. Read More »

-

Money Trends from 2025 (and What They Mean for 2026)

Explore the biggest money trends of 2025—from treat math to feel-good finances—and see how these habits may shape the way we spend and save in 2026. Read More »

-

What is Giving Tuesday?

Maps is giving $10,000 to local non-profits for #GivingTuesday. Here’s how you can help—and spread a little kindness of your own. Read More »

-

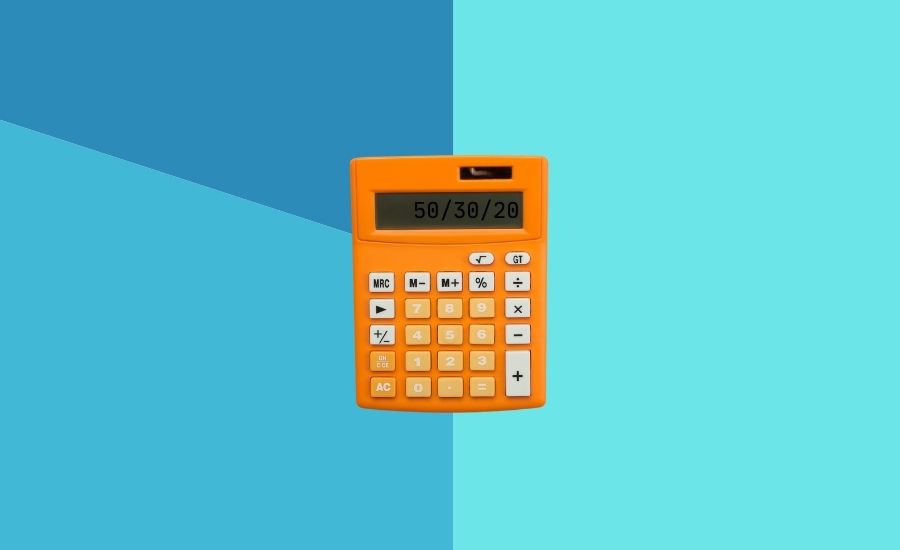

Revisiting 50/30/20 for 2026

Explore how the 50/30/20 rule fits today’s financial landscape and see simple ways to tailor the framework to your needs in 2026. Read More »

-

The Unwanted Customer: How Banks and Credit Unions Battle Fraud Every Day

Scammers are always on the move. See how Maps Credit Union protects members from fraud and what you can do to stay safe. Read More »

-

The 12 Scams of Christmas

From impersonation scams to bogus gift exchanges, we’ve got a festive wrap-up of some seasonal scams to watch out for. Read More »

-

Thanksgiving Budgeting Tips

Is it possible to create a memorable meal on a tight budget? Absolutely! Just follow these Thanksgiving budgeting tips. Read More »

-

Don’t Get Skimmed: Protect Your Card While Holiday Shopping

/

Learn how to spot card skimmers this holiday season and discover key habits to protect your cards—whether shopping locally or traveling. Read More »

-

How to Protect Your Digital Wallet This Holiday Season

The holiday season is here, and despite some economic uncertainty, Americans are predicted to spend a collective $242 billion on holiday gifts in 2025—not to mention nearly $311 billion on holiday travel. Now, more than ever, shoppers are turning to… Read More »