Checking Accounts

Free Community Checking

An everyday account with no fuss, no fees, no minimum balance, and optional direct deposit.

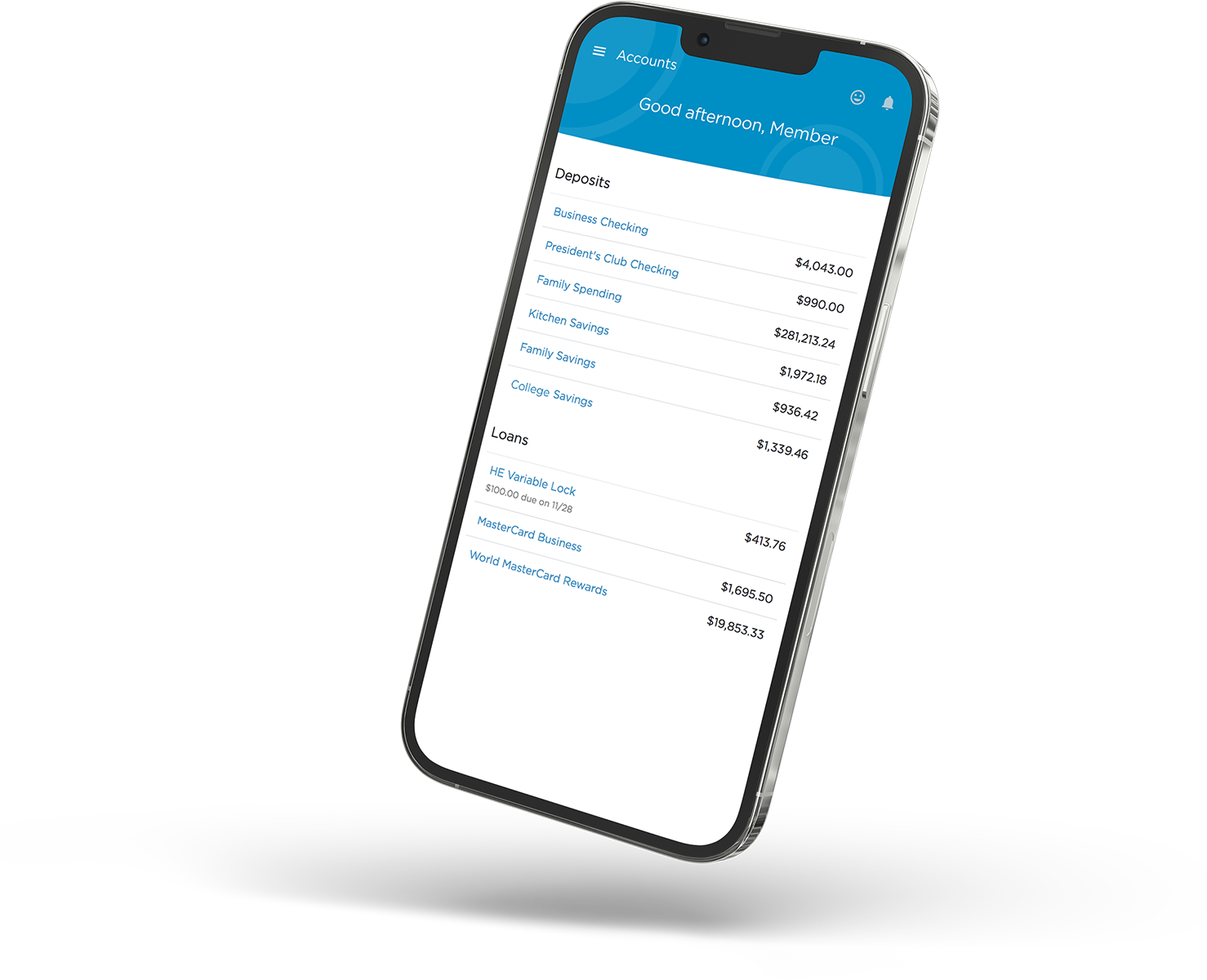

President’s Club Checking

Earn dividends on your balance and enjoy all the conveniences of banking with Maps—plus exclusive perks like unlimited ATM transactions and checks.

Passport

Checking

A checking account for members 55+ that offers dividends on balances over $750, plus a suite of other perks.

Free Community Checking Account

Our most popular free checking account with no monthly fees.

Making a difference is worth every penny. This easy, fast, and no-fee checking account allows you to do everything from paying bills and making deposits to shopping online or swiping your card for gas. Plus, every time you use your Free Community Checking debit card, Maps donates a penny to community causes—at no cost to you. What seems small adds up fast: last year, members helped raise more than $100,000 just by using their Free Community Checking debit card.

- No monthly service fees

- No minimum balance

- No limit on checks

- Free debit card with Mastercard® debit benefits

- Get paid up to two days earlier with Maps direct deposit**

- Free unlimited CO-OP ATMs

- Greenlight: Money App for parents and their children

$25 minimum opening balance.

President’s Club Checking Account

Looking for a dividend checking account with extra perks?

Our President’s Club Checking is perfect for those who keep higher balances and want executive-level perks in their accounts. Earn competitive dividends based on your balance and enjoy premium benefits like exclusive club checks, free cashier’s checks, and added certificate rate bonuses, all with the convenience of a debit Mastercard®.

- Unlimited check writing

- Free President’s Club checks (or $5 credit towards designer checks)

- Free cashier checks

- Free debit card with Mastercard® debit benefits

- A .10% APY% bonus on standard certificate accounts

- Get paid up to two days earlier with Maps direct deposit**

- Free unlimited CO-OP ATMs

- Waived ATM transaction fees at non-Maps ATMs

- Greenlight: Money App for parents and their children

$25 minimum opening balance. $750 minimum average daily balance to earn dividends. $30,000 minimum in combined loans or deposits to avoid $7.50 service fee.

Maps Credit Union will add 0.10% to Certificate of Deposit (CD) rates. This offer is only available when a new standard CD account is opened.

0.20%APY*$10,000 and above

0.15%APY*$750-$9,999.99

Passport Checking Account

Perfect for members 55+

Our passport checking account is perfect for members 55 and older who want a checking account with dividends and added perks. This senior checking option comes with no service charges, unlimited check writing, a free box of checks, and a debit Mastercard®, plus dividends on balances of $750 or more.

- Dividends on average monthly balances of $750+

- No service charges

- Unlimited check writing

- Free box of Passport checks

- Free debit card with Mastercard® debit benefits

- Get paid up to two days earlier with Maps direct deposit**

- Free unlimited CO-OP ATMs

- Greenlight: Money App for parents and their children

$25 minimum opening balance. $750 minimum average daily balance to earn dividends.

0.01%APY*

Frequently Asked Questions

General FAQs

Checking FAQs

** Early Direct Deposit availability depends on the timing of the payor’s payment instructions, and fraud prevention restrictions may apply. Therefore, availability or timing of Early Direct Deposit may vary from pay period to pay period. Make sure your name and social security number, and the credit union routing and account number on file with your employer or benefits provider matches what’s on your Maps Credit Union account. We will not be able to deposit your payment if we are not able to match recipients.

How to stop a recurring payment on a debit card

Rates good as of effectivedate and are subject to change without notice. *APY = Annual Percentage Yield. Fees can reduce earnings.