Maps Digital Tools

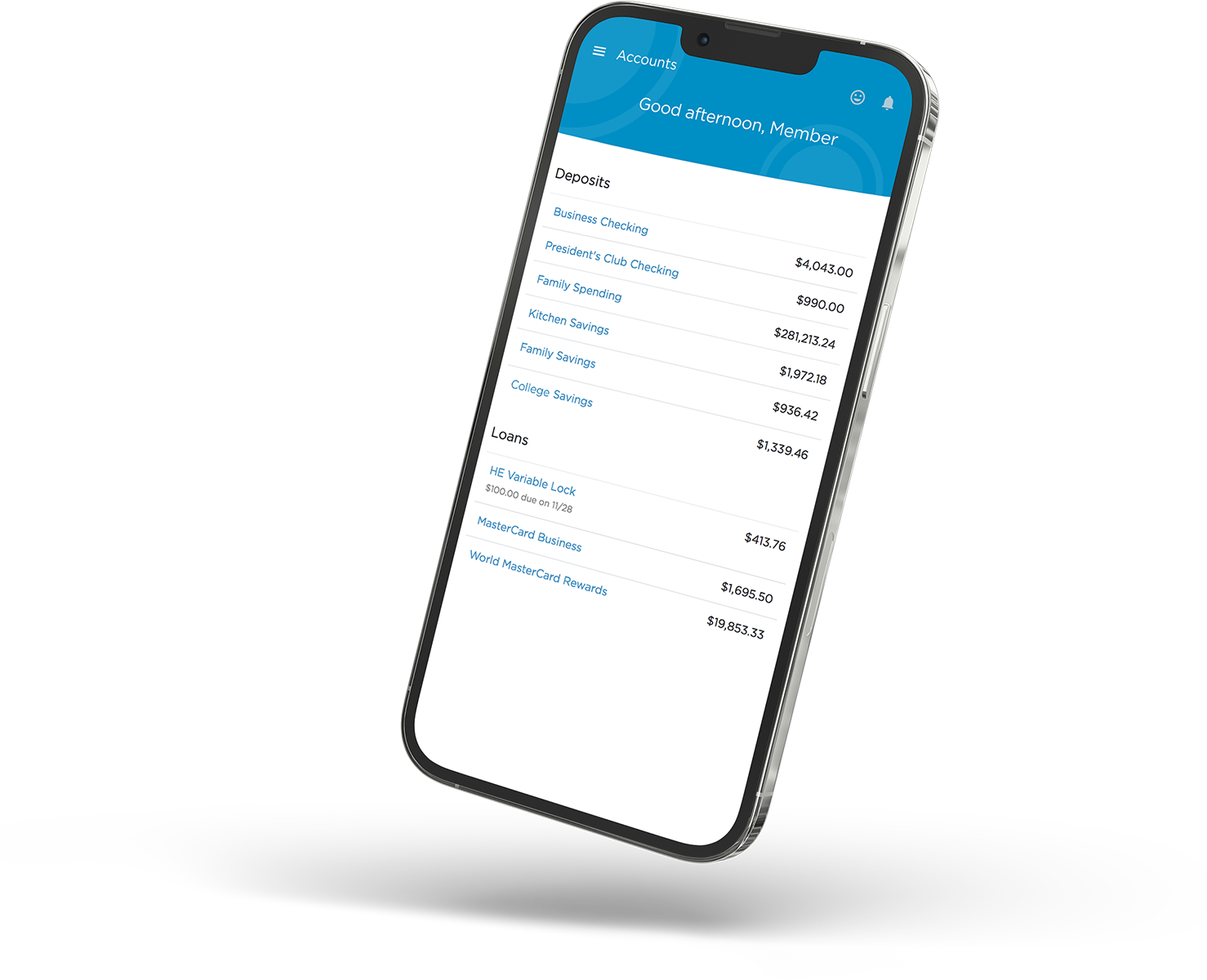

Maps Digital Banking and Mobile App

Bank on the go, wherever you go

Check your balance, transfer funds, pay bills, access online statements, and keep tabs on your budget using our free digital banking service. Here are the features you’ll find:

- Account history

- Financial management tools

- Bill pay

- Account transfers

- Online statements

- Transaction and balance alerts

Sign up for this free service by registering online.

Digital Banking Options

Mobile Check Deposit

Deposit checks without a trip to the branch or ATM! You’ll get an email confirmation when your check has been received and then again when the check has been deposited.

Mobile Wallet and Smartwatch Payments

Your Digital Wallet makes cashless transactions simple. Add your Maps Credit or Debit Card to Apple Pay®, Google Wallet™, or Samsung Pay for quick, secure payments.

Online Bill Pay

Track your payments and eliminate hassle by making loan payments and paying bills through digital banking or our mobile app. You can even simplify life with recurring payments.

Person-to-Person Payments & External Transfers

Pay anyone, anywhere, anytime—or link an external bank account to make transfers for payments to bills or loans.

Money Management

Track your spending and set a budget so you can reach your financial goals more efficiently.

Banking Alerts

Set up balance, loan payment, and transaction alerts through digital banking. You can even set up customized reminders to go straight to your phone or email address.

Home Loan App by Maps

The Home Loan App by Maps CU is designed to streamline the homebuying process by connecting our Maps Mortgage Team with borrowers, real estate agents, and settlement agents in a single location for easy communication throughout the entire home buying and selling cycle.

Get the Home Loan App:

What can you do with the app?

Mortgage Calculator

Determine spending limits and run loan scenarios through a convenient and easy-to-use mortgage loan calculator.

Get Started On-The-Go

Start your mortgage process remotely or get your application completed in a safe and secure way. You can save and return whenever it’s convenient for you.

Get Notified

Receive push notifications when documents are needed during the loan process or when major milestones are reached.

Scan With Your Phone

Scan in required documents on your phone and upload them quickly and easily to expedite your approval.

Stay Updated

Track your loan progress through the entire process from application to closing.

Instant Chat

Use the Chat Now feature to connect with your loan officer or realtor and help will be just a click away.

Hybrid e-Close

Enjoy the option to experience the new Hybrid e-close and sign most of your documents ahead of time (notarized documents excluded).