Credit unions have been around since the early 1900s, but many people still don’t fully understand how they work—and we get it. We’ve been in service for 90 years, and we’ve heard just about every myth there is about credit unions. Some people still believe you have to belong to a secret club to join. Others imagine credit unions as small-town outfits with outdated technology and limited services. These ideas have been passed around for decades, but they don’t reflect how we actually work—or how we’ve grown alongside the communities we serve.

Today’s credit unions are modern, regulated, and accessible. And while the myths haven’t gone away, we think it’s worth setting the record straight.

1. Credit Unions Are Hard to Join

It’s true that in the early days, many credit unions—including Maps—had very specific membership requirements. You might have needed to work for a certain employer, belong to a trade association, or reside in a narrowly defined area. But, over time, those parameters have broadened. Today, eligibility is typically based on where you live, work, go to school, or even family ties. You are eligible to join Maps if you:

- You live or work in the Greater Western Oregon region.

- You are related to someone who is a member or is eligible to be a member. This includes parents, spouses, children, stepchildren, grandparents, grandchildren, brothers, sisters, half-siblings, aunts, uncles, and domestic partners of eligible members.

- You have been a Maps member at any time.

2. Credit Unions Offer Limited Services

There’s a lingering idea that credit unions are only good for basic savings accounts and little else. At Maps, that couldn’t be further from the truth. In fact, members have access to the same full range of financial products you’d expect from a traditional bank—like checking and savings accounts, mortgages, auto loans, credit cards, and money market accounts, to name a few. Members also have access to financial planning and wealth management as well as free credit coaching and business services—all designed to grow with them throughout every stage of life. If you can do it at a bank, chances are you can do it here, too.

3. Credit Unions Have Limited Technology

We live in a digital age, and technology is a fundamental part of modern banking. At Maps, we know that members expect 24/7 access to their accounts via online platforms and mobile apps. So, for us, being member-focused means constantly rethinking how to make banking easier. That’s why we invest in technology—from our mobile app and online banking to remote check deposit and digital payments—so members can safely manage their money whenever and however they need. Convenience, security, and accessibility aren’t just features; they’re part of putting members first.

4. Credit Unions Don’t Offer as Much ATM Access

Maps Credit Union is part of the Credit Union CO-OP ATM network, which means Maps members have access to 30,000 fee-free ATMs nationwide. As a Maps member, you can use any CO-OP ATM as you would a Maps ATM to access your cash, check your balance, and transfer funds without paying extra fees. Some co-op ATMs will even allow check or cash deposits. You can find a CO-OP ATM using your mobile app, our website locator tool, or by texting your ZIP code or city/state to 91989.

5. Credit Unions Are Only for Low-Income People

Credit unions were founded on the principle of helping people access affordable financial services, but today they serve everyone. At Maps, our members span all income levels—from first-time savers to high net-worth individuals. Many choose Maps not only to manage and grow their wealth wisely, but also to be part of a cooperative that puts members and the community first. After all, banking here isn’t just about financial products—it’s about knowing your decisions help shape and support the communities you care about.

6. Credit Unions Are Uninsured

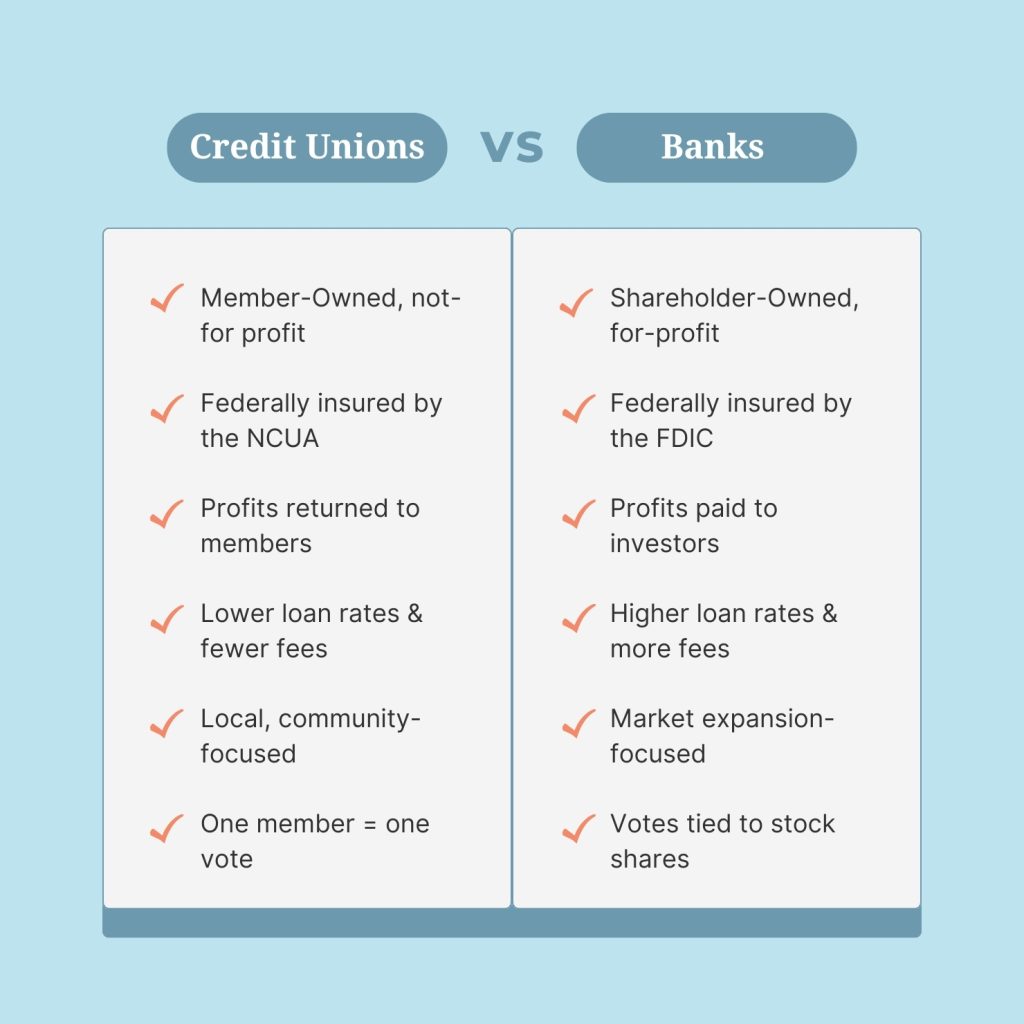

This one is just flat-out false. Credit unions, like Maps, are federally insured by the National Credit Union Administration (NCUA), with the same coverage limits the FDIC provides for banks: up to $250,000 per depositor, per account category.

7. Credit Unions Aren’t Regulated Like Banks

Credit unions are highly regulated, and Maps is no exception. We follow strict federal and state guidelines designed to ensure safety, soundness, and consumer protection. This oversight covers everything from how we handle deposits to how loans are approved, giving members confidence that their money is secure. Being a member-owned cooperative doesn’t mean we operate with less scrutiny—in fact, our commitment to transparency and compliance is a key part of how we put members first.

8. Credit Unions Don’t Offer Perks or Competitive Rates

Because we are a not-for-profit organization, Maps is able to return earnings directly to its members. That means lower loan rates, higher savings rates, and fewer fees compared with many traditional banks. Beyond those not-so-basic basics, we offer rewards programs, discounts, and other member perks designed to make banking more rewarding and convenient. For most people, being a credit union member means gaining real value while helping strengthen a cooperative that puts members and the community first.

9. Credit Union Loans Have to Be Approved By a Board, So They Take a Long Time to Process

This is a very old myth, but we still occasionally hear it! Credit union loan approvals work just like loan approvals at a bank—processed by lending staff, often within the same day. Today, technology and streamlined processes enable things to move quickly. The one exception is very large commercial loans, which may require additional review due to regulatory limits or the complexity of the borrowing request.

10. Credit Unions Are Only Good for Local Banking

Sure, credit unions are rooted in their communities, but that doesn’t mean they’re limited. Maps members can access thousands of fee-free ATMs nationwide through the CO-OP network, use their debit and credit cards internationally, and manage their accounts from anywhere in the state—or across the country—through our online and mobile banking tools. Being part of Maps means you can bank wherever life takes you, without losing the personal service and member focus you expect.

11. Credit Unions Are Only for Personal, Not Business Banking

Okay, this myth has a basis in history, but times have really changed. In the past, credit unions were subject to regulations that limited their ability to serve businesses, so many chose to focus on personal banking—at least at first. Maps started serving business members in 2004. Today, we offer a comprehensive suite of business banking products and services—including checking and savings accounts, credit cards, commercial loans, and merchant services, as well as personalized support for companies of all sizes. Essentially, when you open a business account, your local Maps representative gets to know you and your goals—which is particularly beneficial for small businesses and nonprofits.

12. Credit Unions Don’t Pay Taxes

Credit unions are exempt from federal income tax because they’re structured as not-for-profit cooperatives. But they do pay state and local taxes, payroll taxes, and property taxes. The tax exemption enables them to return more value to their members.

So, in a nutshell, we may not have the same nationwide name recognition as big banks, but we offer safe, reliable, and modern financial services (with the added benefit of being member-owned and community-focused). If you have questions about how we operate or who we are, just ask! We’re always happy to discuss the credit union difference. And, if you’ve written off credit unions based on these myths, it might be time to take another look.

Want more facts about credit unions and banking?

- Check out the history of credit unions in Oregon and beyond.

- Discover some ICYMI facts about Maps Credit Union.

- Learn about the Fed and Central Banks.