When money is tight, a loan can feel like a lifeline. But not all loans are created equal. Some lenders use unfair or deceptive practices to take advantage of people who are financially stressed, vulnerable, or simply in a hurry. The practice is called predatory lending, and while some forms are legal, it remains all too common.

What Is Predatory Lending?

While all loans are designed to benefit the lender to some extent, responsible loans provide clear value to the borrower. Predatory loans, on the other hand, tip the balance unfairly by using unfair, deceptive, or aggressive tactics to trap borrowers in loans that are expensive, confusing, or nearly impossible to repay.

Some common forms include:

- Payday loans. These are short-term loans with fees that can translate to interest rates over 400% APR.

- Car title loans. These loans use your car as collateral, and if you can’t repay, you risk losing your vehicle. They are banned in Oregon but remain common in many states.

- High-cost installment loans. These loans come with long repayment schedules and high interest, which can cause borrowers to pay back far more than they originally borrowed.

- Certain subprime mortgages. These loans target borrowers with poor credit and often conceal fees or include balloon payments. They were especially widespread before the 2008 housing crisis, though some risky versions still exist today.

Why Predatory Lending Is Problematic

On the surface, predatory loans can seem like a quick, easy solution—especially when you’re dealing with a financial emergency. But predatory lenders often use aggressive tactics that encourage borrowers to take out loans they cannot reasonably repay. They exploit some borrowers’ limited financial knowledge and use murky terms to target people with few credit options. Some lenders even aggressively advertise online, via social media, or through other channels where regulations allow outreach, including calls or texts.

When Predatory Lending Becomes a Scam

Predatory lending may be legal in some cases, but certain practices cross the line into scams. In those cases, lenders are not just profiting unfairly—they are deceiving borrowers or misusing personal information to extract money. Examples include:

- Fake online lenders. Fraudsters set up convincing websites, collect personal details like Social Security numbers or bank account info, and then disappear—or use your information for identity theft.

- Bait-and-switch tactics. Lenders advertise one set of loan terms, but the final paperwork hides much higher interest rates or costly fees.

- Phantom loans. Scammers promise quick approval if you pay upfront fees, but the loan never materializes.

- Equity stripping. Shady lenders convince homeowners to borrow against their home equity, knowing repayment is impossible, with the goal of forcing foreclosure.

Oregon has laws against fraudulent, deceptive, or misleading lending practices, including misrepresentation of loan terms, hidden fees, or identity theft. What’s more, the Oregon Department of Justice and the Department of Consumer and Business Services actively investigate and take action against lenders who break these rules. So, if you’re ever pressured to sign something that doesn’t match what you were promised, or asked to pay fees before receiving funds, treat it as a red flag and report it to the Oregon Department of Justice Consumer Hotline at 1.877.877.9392 or file a complaint online at oregonconsumer.gov.

Adding insult to injury, these loans often pressure borrowers to take on more than they need, typically at interest rates far above market levels. Hidden fees and penalties are frequently buried in fine print.

Oregon HB 2561 and the Debate Over Consumer Loan Protections

Oregon has long protected consumers with a 36% cap on interest rates for short-term loans, but some out-of-state lenders have found ways around it. In recent years, banks have offered Oregonians online loans with APRs ranging from 73% to over 200% by using federal rules that override state limits. To address the issue, the Oregon House passed a bill in February 2025 that aimed to opt the state out of this federal provision. But the bill faced opposition from financial industry groups, and—in the words of the American Fintech Council, it was seen as “a blunt and legally questionable legislative solution for an issue that requires nuance.” The bill didn’t make it through the Senate before adjournment, but lawmakers and consumer advocates expect the issue to return in future sessions as they push to strengthen protections against predatory lending.

“We need to put a stop to predatory practices by closing the loophole that has allowed these out-of-state lenders to violate the spirit, if not the letter, of our law,” stated Rep. Nathan Sosa (D-Greater Hillsboro). “We have to ensure that Oregonians, in a moment of financial need, are not being preyed upon by digital, corporate loan sharks.”

How to Avoid Predatory Lending

The good news is that you can protect yourself from these practices by knowing what to look out for (and where to turn instead). Here’s what to do:

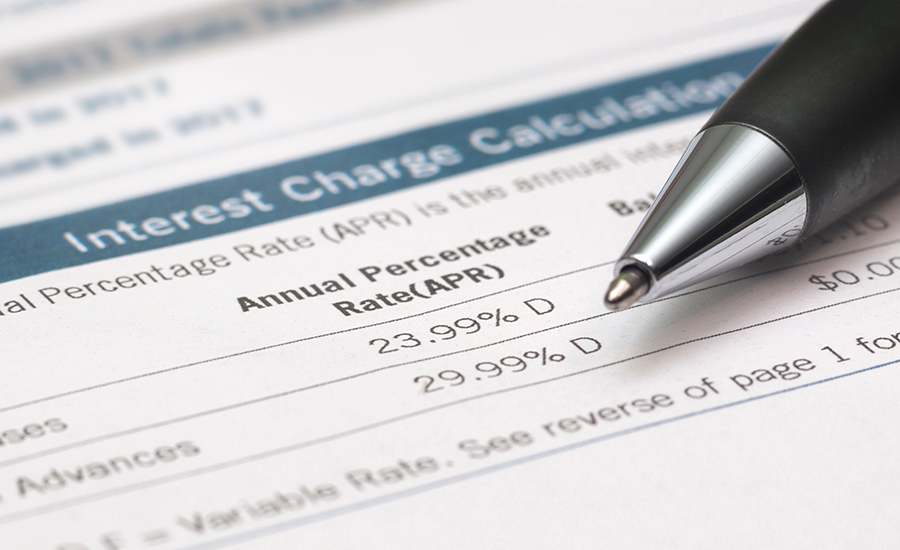

1. Check the APR. If the annual percentage rate seems unusually high, that’s an immediate red flag. Research the regional market rates for the type of loan you are considering (but take your credit score into consideration). Any rate that is well above typical local rates should raise alarm bells.

2. Read the terms carefully and watch for vague language—like “fees may apply” or “other charges”—as well as balloon payments or penalties for paying off the loan early.

3. Be cautious with “quick cash” ads and remember the golden rule of scams: If it sounds too good to be true, it probably is.

4. Look for trusted lenders. A credit union or reputable bank will be transparent about fees and repayment schedules.

If you ever feel pressured into taking a loan you don’t fully understand, pause and seek advice before signing anything. At Maps, for example, we’re committed to helping members find fair, affordable borrowing solutions. After all, we want you to be able to pay off your loan because a loan should help you move forward, not trip you up. That’s a major reason why credit unions were founded in the first place. So, taking a moment to understand the terms, compare options, and ask for advice can make all the difference in protecting your finances.

Want more tips for safely managing debt?

- Learn 8 tips for spotting (and avoiding) student loan scams.

- Discover the signs of debt relief scams.

- Find out how AI is making financial scams harder to detect.