We talk a lot about how credit scores influence our buying power, but they do more than just open financial doors. They shape the way we live.

That’s because, when it comes to buying a house, your credit score may affect where you’re allowed to buy, how much you pay upfront, and how smoothly the application process goes. If you’re renting while saving for a down payment on a house, you probably already know that. But even if homeownership isn’t your goal, those three-digit numbers may play a big role in your financial stability, peace of mind, and long-term options—especially when it comes to finding and securing housing.

It Starts with a Credit Check

When you apply to rent or lease a place, most landlords or rental companies review your credit as part of the application process. It’s typically a soft inquiry (so it won’t impact your credit score) that helps them assess how reliable you are when it comes to paying bills on time. Many experts suggest renters need a credit score of at least 600 to qualify without extra conditions, although expectations can vary by location and market demand.

A low credit score won’t automatically disqualify you, but it might mean you’ll need a larger security deposit or a co-signer. In some cases, however, you could be passed over for renters with more competitive scores—especially if your credit report includes late payments, collections, or high debt. For most landlords, those are major red flags.

How Credit Scores Shape Communities

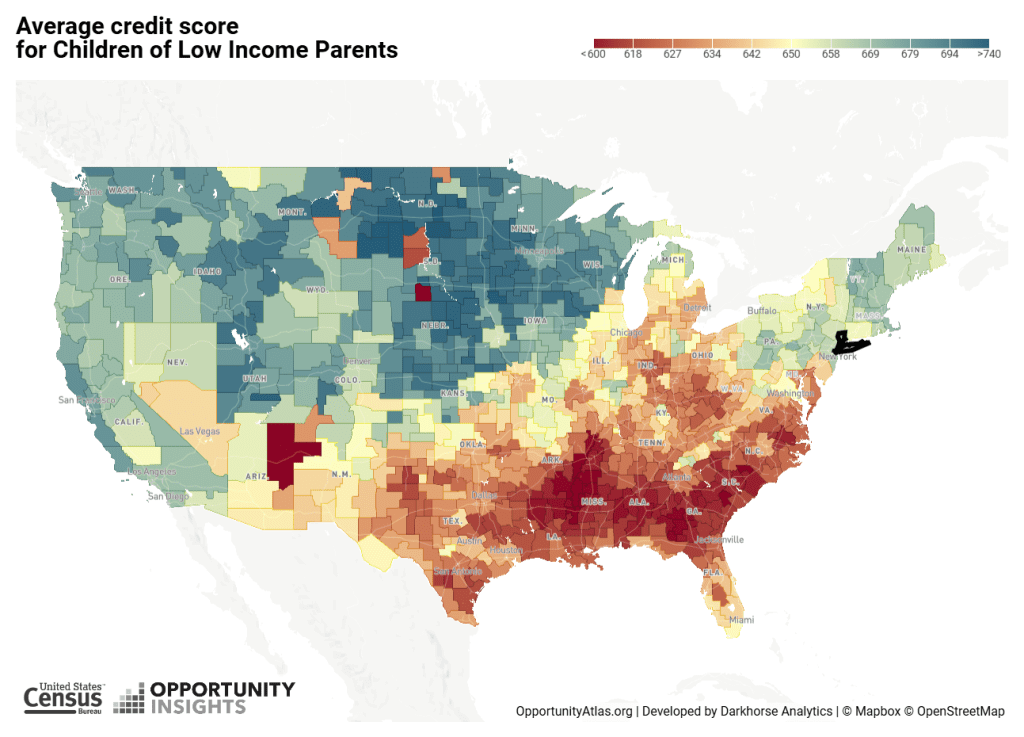

On a personal level, our credit scores may influence where we live and how much we pay to borrow, buy, or rent. But they aren’t just a personal issue. On a larger scale, credit scores impact and reflect broader systems, histories, and opportunities that affect entire communities.

Nationwide, the average credit score is around 715—a number that is considered “good” by most lenders. But according to recent studies, individuals who grew up in Marion County have an average score of 666. In Polk County, it’s 669. Both fall in the “fair” range.

It’s important to note that this data reflects where people were raised, not necessarily where they live now, but it speaks volumes about the economic opportunity and financial access available across the community.

And that’s because lower average scores tend to limit access to affordable credit, housing, and even job opportunities. When credit scores are lower across a community, predatory lenders tend to take root—crowding out responsible lenders like weeds in a neglected garden. These high-cost lenders often trap people in cycles of debt instead of helping them build credit. When those barriers persist over generations, it becomes harder for whole communities to break the cycle of economic hardship.

So, in the short term, building better credit can help you stand out in a competitive rental or lending market. In the long term, it’s a step toward stronger, more resilient communities.

Beyond Approval

Low credit scores are often seen as a sign of financial missteps, but that doesn’t always reflect the full picture. For some people, lower credit scores simply stem from limited access to funds or credit-building resources—and it’s a cycle (see left). A lack of credit or poor credit leads to higher costs, which makes it harder to rebuild credit or get ahead.

Regardless of the cause, landlords tend to view low-scoring applicants as high risk. So even if your rental application is approved, your weaker credit history could mean stricter lease terms or a limit on which units you’re eligible for. At the very least, you’re likely to pay a higher security deposit.

On the flip side, strong credit can give you more flexibility, possibly even putting you in a better position to negotiate terms or move in faster.

Keeping Future Options Open

Of course, plenty of people are happy to rent long-term, but if buying a home is part of your future plans, healthy credit should be your goal. And that’s because mortgage lenders evaluate your creditworthiness much like landlords do, by looking at your payment history, credit utilization, and how you manage your debt.

So, if you want to buy a house, think of your rental era as your opportunity to lay the groundwork for mortgage approval (not to mention better interest rates) down the road.

Frankly, it’s worth keeping your credit in good shape no matter what—even if you’re 99% certain you don’t want to buy a house. After all, the better your credit score, the more control you’ll have over your future options.

Tips for improving your credit while renting

You don’t need perfect credit to find a place to live (but it helps). You don’t even need perfect credit to secure a mortgage someday. But stronger credit could lead to more choices, lower upfront costs, and a smoother path ahead—no matter where you’re headed.

If your current credit score is a little bruised, don’t give up. It’s not permanent. To boost your score:

- Pay your bills on time, every time. That includes credit cards, student loans, utilities, and any recurring payments.

- Keep your credit usage low. Try to use less than 30% of your available credit across cards.

- Avoid unnecessary hard inquiries. Too many new applications can lower your score temporarily.

- Consider rent-reporting services. Some programs allow your rent payments to count toward your credit history.

With consistent habits and a little strategy, you can build a healthier score over time. And whether you’re planning to rent long-term or eyeing homeownership in the future, maintaining good credit gives you more freedom to make decisions on your own terms.

Want more tips for improving your credit score?

- Learn how to get (and use) a credit report.

- Discover how to give yourself a credit glow up.

- Find out how to pay off debt faster.