If you are familiar with the history of Maps Credit Union, you know that we started as a credit union for teachers and school employees. So, it makes sense that we would still have a soft spot for learning. But have you ever wondered why Maps (and other great credit unions) are so focused on educating their members? The answer is pretty simple. When our members thrive, so does our community.

The Credit Union Difference

Credit unions exist to serve their members, not shareholders. Around the world—not just here in Oregon—they operate as member-owned cooperatives, focused on helping people access fair, affordable, and practical financial services. In the credit union world, this commitment is often referred to as “the credit union difference.”

That difference comes through in many ways—especially in our commitment to financial education, where we focus on helping members manage their money, plan ahead, and make informed choices that strengthen whole communities.

Why? Because when members understand how credit works, how to save effectively, and how to navigate major life expenses, they gain confidence and independence. That empowerment ripples outward. A member who avoids costly mistakes or reaches a financial milestone not only strengthens their own life but also the community around them. So, in this way, education becomes a force multiplier: when our members thrive, the credit union and the broader community thrive as well.

What Does Financial Education Look Like?

Financial education can take many forms, from workshops and counseling to school partnerships and online resources. But, across the board, our aim is to create programs that make learning interactive and accessible for both children and adults. Here are some of our current favorite programs:

The Bite of Reality

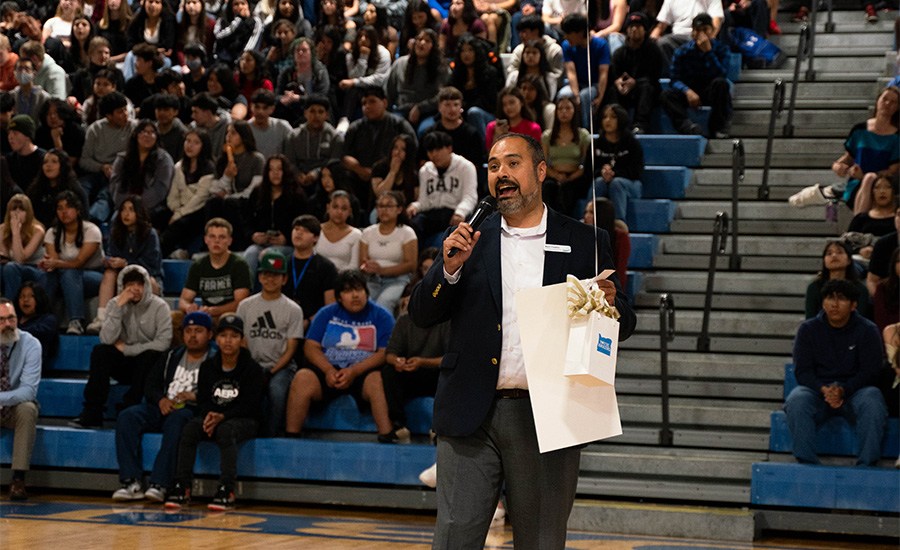

Bite of Reality is an in-school program for high school students that provides a hands-on budgeting simulation designed to teach teens the real costs of adulthood. The one-day event places students in the driver’s seat of adult financial decision-making—complete with jobs, expenses, surprise costs, and even families to support. As they move from table to table, they make choices about housing, transportation, and childcare, gaining a clearer understanding of how far a paycheck really goes.

High School Branch

Our award-winning high school branch gives students a chance to step into real-world banking roles while still in school. Teens who work in the branch gain hands-on experience with customer service, transactions, and financial decision-making, while their peers benefit from access to a functioning branch on campus. This program helps students build confidence, develop practical skills, and see firsthand how the financial system works—all in a supportive, educational environment. Plus, many of the teens who work in our high school branch go on to have careers at Maps or other great financial institutions.

The Greenlight Debit Card and App

Our younger members can explore money management through the Greenlight debit card and app, which combines safety, convenience, and learning opportunities. Once enrolled, kids get a real debit card that their parents or guardians can load with allowance or earned money. They can then use the card to make purchases while learning to track their saving and spending habits. The accompanying app lets both kids and parents monitor transactions, set savings goals, and engage with Level Up games that turn financial lessons into interactive challenges. These tools make it easy for kids and teens to practice budgeting and responsible spending with guidance from their parents.

Workshops and Coaching for Adults

We also offer programs and workshops designed to help adults reach their financial goals. For example, our quarterly Home Buyers Classes guide members through the entire home-buying process, from budgeting to applying for mortgages. We also partner with GreenPath Financial Wellness, a non-profit that provides personalized coaching on debt, savings, and budgeting. Their mission is to empower people to lead financially healthy lives, and their resources give our members the tools they need to make smart, confident decisions about their future.

Silvur Insurance

Silvur Insurance is one of our newest partners, offering free guidance and support to Maps members trying to navigate Medicare plans. Their agents can walk you through how plan changes might affect your coverage or costs, and help you compare options from different providers. Whether you’re learning about Medicare for the first time or making changes to an existing plan, they provide one-on-one support to help you feel informed and confident. And, like many of the educational opportunities we offer, their guidance is free, and there’s no obligation to sign up for a plan.

Community Partnerships

Maps Credit Union employees also volunteer with local non-profits to bring financial education and support into the broader community. Every Maps employee receives 25 paid volunteer hours each year, and with more than 300 employees out in the community, those hours add up! Whether it’s teaching budgeting basics, supporting local schools, or helping families access resources, our team is committed to making financial education accessible and meaningful beyond the walls of our branches.

Online Resources

And of course, there’s our Maps blog—the very place you’re reading this now. We cover everything from saving and investing to avoiding scams and planning for the future. It’s just one more way we share tools, tips, and stories to help members (like you) feel more confident about money.

A Rising Tide Lifts All Boats

At its core, this focus on education reflects the cooperative philosophy that sets credit unions apart from banks and other for-profit financial institutions. Members aren’t just customers; they’re partners. By equipping them with knowledge and tools to succeed, we move forward together. We believe that stronger members mean stronger communities, and that’s the ripple effect credit unions strive to create every day.